By: Chad T. Wishchuk, Esq. of Finch, Thornton & Baird, LLP.

Authored by California State Assembly Member, Lorena Gonzalez, and recently signed into law by Governor Newsom, Assembly Bill 5 (AB 5) will affect employers and independent contractors throughout California for years to come. In his signing statement, the Governor noted that while AB 5 was an important step, “a next step is creating pathways for more workers to form a union.”

WHAT AB 5 MEANS TO THE CONSTRUCTION INDUSTRY

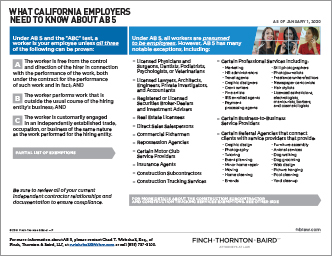

AB 5 codifies a strict ABC test for all persons and entities providing services in California to determine if they are independent contractors. The law provides many exemptions, however, including for construction subcontractors. There are also ambiguities about how the law impacts some business-to-business professional services.

THE IMPACT OF AB 5 ON CONSTRUCTION TRUCKERS

Construction trucking services also are exempted, but in a more limited fashion, and only for two years. The law will require independent owner-operators for construction projects to have direct written compensation agreements with a licensed contractor. They must also be registered with the Department of Industrial Relations as a public works subcontractor, “regardless of whether the subcontract involves public work.” It would appear that AB 5 seeks make independent owner-operator truckers and brokers a thing of the past, in favor of all truckers being wage-earning employees with benefits who can be organized into a union.

PREPARING FOR THE JANUARY 1, 2020 DEADLINE

The need to clarify — and prepare for — the law’s impact on your business is imperative. Consultation with Finch, Thornton & Baird, LLP, or your own legal experts, is strongly recommended.

To schedule a review of your company’s exposure to AB 5, please contact Chad T. Wishchuk of Finch, Thornton & Baird, LLP at (858) 737-3100.

To learn more about AB 5, or to request a PDF of our AB 5 presentation, email Chad Wishchuk here.

For a PDF of our 2-page AB 5 handout, click here.