By: Chad T. Wishchuk, Esq. of Finch, Thornton & Baird, LLP.

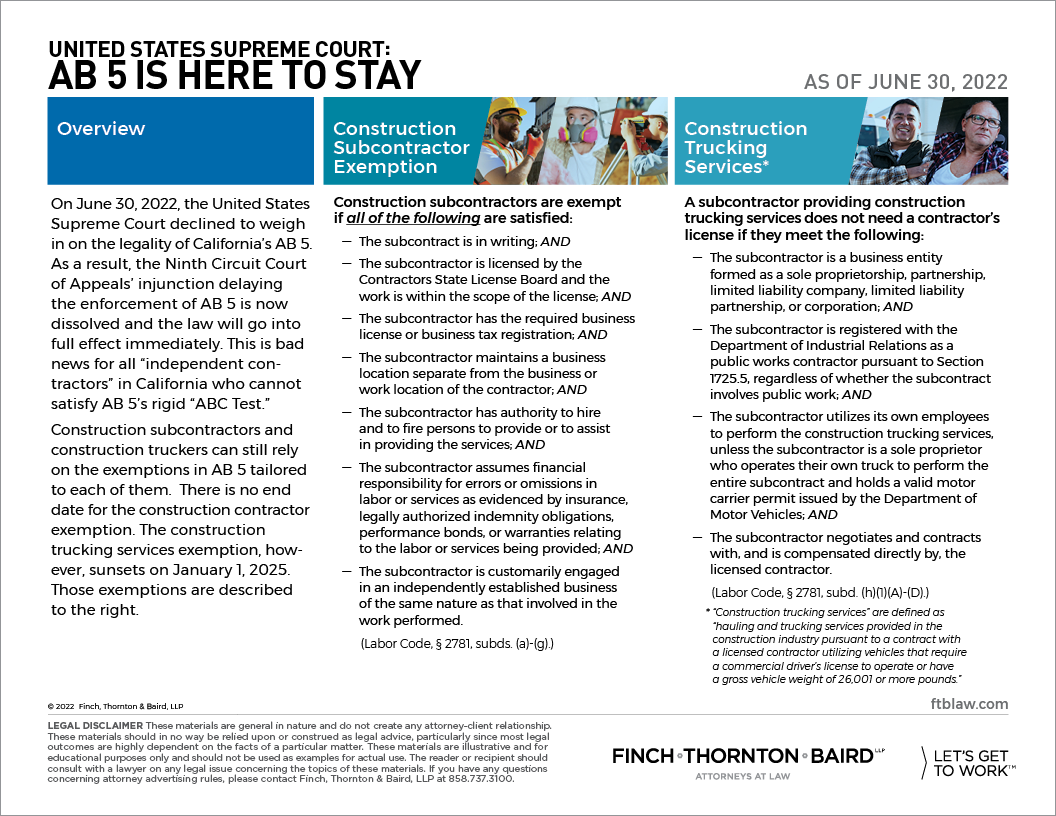

On June 30, 2022, the United States Supreme Court declined to weigh in on the legality of California’s AB 5. As a result, the Ninth Circuit Court of Appeals’ injunction delaying the enforcement of AB 5 is now dissolved and the law will go into full effect immediately. This is bad news for all “independent contractors” in California who cannot satisfy AB 5’s rigid “ABC Test.”

Construction subcontractors and construction truckers can still rely on the exemptions in AB 5 tailored to each of them. There is no end date for the construction contractor exemption. The construction trucking services exemption, however, sunsets on January 1, 2025.

Construction subcontractors are exempt if all of the following are satisfied:

- The subcontract is in writing; AND

- The subcontractor is licensed by the Contractors State License Board and the work is within the scope of the license; AND

- The subcontractor has the required business license or business tax registration; AND

- The subcontractor maintains a business location separate from the business or work location of the contractor; AND

- The subcontractor has authority to hire and to fire persons to provide or to assist in providing the services; AND

- The subcontractor assumes financial responsibility for errors or omissions in labor or services as evidenced by insurance, legally authorized indemnity obligations, performance bonds, or warranties relating to the labor or services being provided; AND

- The subcontractor is customarily engaged in an independently established business of the same nature as that involved in the work performed.

(Labor Code, § 2781, subds. (a)-(g).)

A subcontractor providing construction trucking services* does not need a contractor’s license if they meet the following:

- The subcontractor is a business entity formed as a sole proprietorship, partnership, limited liability company, limited liability partnership, or corporation; AND

- The subcontractor is registered with the Department of Industrial Relations as a public works contractor pursuant to Section 1725.5, regardless of whether the subcontract involves public work; AND

- The subcontractor utilizes its own employees to perform the construction trucking services, unless the subcontractor is a sole proprietor who operates their own truck to perform the entire subcontract and holds a valid motor carrier permit issued by the Department of Motor Vehicles; AND

- The subcontractor negotiates and contracts with, and is compensated directly by, the licensed contractor.

(Labor Code, § 2781, subd. (h)(1)(A)-(D).)

* “Construction trucking services” are defined as “hauling and trucking services provided in the construction industry pursuant to a contract with a licensed contractor utilizing vehicles that require a commercial driver’s license to operate or have a gross vehicle weight of 26,001 or more pounds.”

Want to learn more?

Please contact Chad T. Wishchuk or Marlene C. Nowlin of Finch, Thornton & Baird, LLP at (858) 737-3100.

DISCLAIMER: This new law advisory is a publication of Finch, Thornton & Baird, LLP, for the purpose of providing information relating to recent legal developments. It is not intended, nor should it be used, as a substitute for specific legal advice, and it does not create an attorney-client relationship.